Evaluating Titan Share Price Performance: Trends and Opportunities

Titan Company Limited, a prominent player in the Indian consumer goods industry, has garnered significant attention from investors due to its strong brand presence and diversified product portfolio. As investors seek to capitalize on potential opportunities in the stock market, evaluating Titan’s share price performance becomes crucial. In this article, we’ll delve into an analysis of Titan’s share price trends and explore opportunities for investors, while also highlighting the importance of managing demat account how to open process charges for optimizing investment returns.

Understanding Titan Company Limited:

Titan Company Limited, a subsidiary of the Tata Group, is renowned for its wide range of consumer products, including watches, jewelry, eyewear, and accessories. With a focus on innovation, quality, and customer satisfaction, Titan has established itself as a market leader in the Indian retail sector.

Analyzing Titan Share Price Performance:

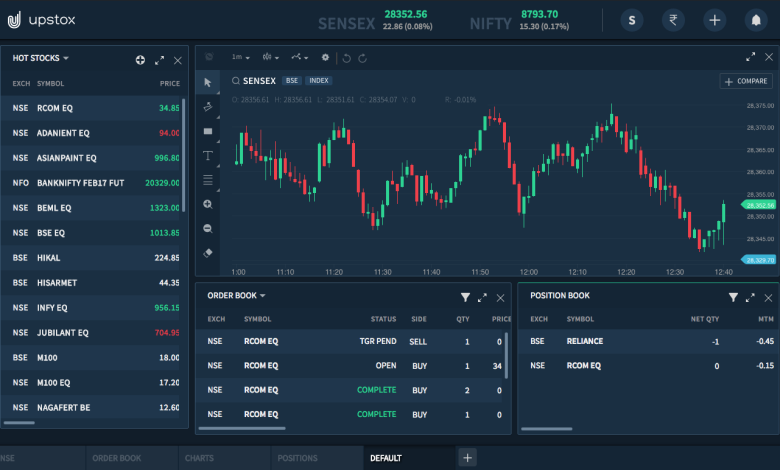

Examining Titan’s share price performance over the years reveals important trends and patterns. Investors analyze historical data to identify price trends, support and resistance levels, and potential areas of price consolidation or breakout. Evaluating the recent Titan share price movements provides insights into its short-term performance and investor sentiment. Factors such as quarterly earnings reports, industry developments, and macroeconomic trends can influence short-term price fluctuations.

Technical indicators, such as moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence), help investors assess Titan’s share price momentum and identify potential buying or selling opportunities regarding demat account how to open process.

Fundamental factors, including revenue growth, profitability, market share, and competitive positioning, play a significant role in determining Titan’s long-term share price performance. Investors analyze fundamental metrics to gauge the company’s underlying strength and growth potential as per the Titan share price.

Opportunities for Investors:

Titan’s expansion into new geographic markets presents growth opportunities for the company. As it continues to penetrate untapped regions and target new customer segments, investors may anticipate increased revenue and market share, potentially driving Titan share price appreciation. Titan’s focus on innovation and product development allows it to stay ahead of consumer trends and preferences. New product launches and innovations in existing product categories can enhance Titan’s competitive edge and attract investors seeking exposure to innovation-driven companies.

Embracing digital transformation initiatives can position Titan for future growth and efficiency gains. Investments in e-commerce platforms, digital marketing, and omnichannel retailing can expand its reach and customer engagement, offering investors opportunities for long-term value creation with the help of demat account how to open process charges.

Titan’s international expansion initiatives present avenues for geographic diversification and revenue growth. As it explores opportunities in overseas markets, investors may benefit from potential revenue streams generated from global operations.

Conclusion:

As investors evaluate Titan’s share price performance and assess potential opportunities, conducting a comprehensive analysis of historical and recent trends becomes imperative. By analyzing key performance indicators, Tata share price, identifying growth drivers, and considering fundamental and technical factors, investors can make informed investment decisions. Additionally, managing demat account how to open process strategically is essential for optimizing investment returns and maximizing profitability. By adopting a holistic approach to investing and diligently managing these charges, investors can capitalize on opportunities in the stock market and achieve their financial goals with confidence.